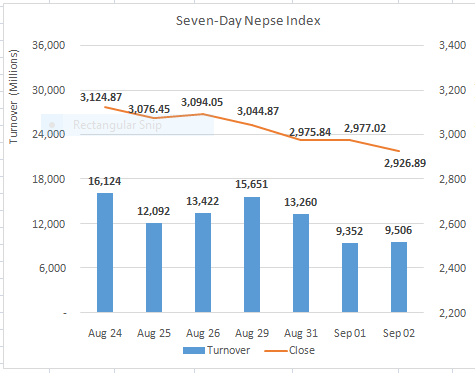

KATHMANDU, September 2: The equity market opened in positive territory but traded in red within the first trading hour on Thursday. After a failed recovery attempt at mid-day, the index continued to falter throughout the afternoon session. At the close, Nepse ended more than 50 points lower at 2,926.89.

Although stocks found footing in the day earlier, the recent selling pressure continued to bring the market towards its July low. The current correction stands at more than 270 points from its August high. In each of the earlier three corrections of 2021, the index has lost around 250-300 points after which the market has resumed its uptrend, pointing towards possibility of a rebound in the coming days. Turnover stayed below Rs. 10 billion mark for a second consecutive day.

All sectors turned red with Finance and Hydropower segments tumbling 3.68% and 3.39%. Development Bank and Investment sub-indices also came under pressure and closed more than 3% lower. Life Insurance sub-index fell 2.13%. All other segments ended in negative territory. Heavyweight banks closed 0.83% lower.

Arun Valley Hydropower Development Company Ltd continued to lead the list of actives with over Rs. 574 million worth of the stock changing hands. Api Power Company Ltd and Ngadi Group Power Ltd followed with turnovers of Rs. 330 million and Rs. 233 million. United Modi Hydropower Ltd, Himalayan Distillery Ltd and Deprosc Laghubitta Bittiya Sanstha Ltd were also heavily traded on Thursday.

Newly listed Sanima Life Insurance Ltd and Manakamana Smart Laghubitta Bittiya Sanstha Ltd were the day’s major gainers with both scrip rallying to hit the upper circuit mark. Chandragiri Hills Ltd, Khani Khola Hydropower Co. Ltd and Deprosc Laghubitta Bittiya Sanstha Ltd rose around 5% apiece.

On the other hand, Narayani Development Bank Ltd, Corporate Development Bank Ltd and Arun Kabeli Power Ltd suffered the most with each stocks plunging more than 6%. NRN Infrastructure and Development Ltd, Karnali Development Bank Ltd, Progressive Finance Ltd and Best Finance Company Ltd were the other major laggards with losses of more than 5% apiece.

On the corporate front, Deprosc Laghubitta Bittiya Sanstha Ltd announced a dividend for the fiscal year 21/22 becoming the first micro sector lender to distribute returns to the shareholders. The microfinance company has declared 20% bonus shares and1.053% cash dividend for tax purposes.

As per the ARKS technical analysis the index formed a strong bearish candlestick reflecting sellers dominance in the market. A plunge of over 270 points has brought the index close to its 2,900 support mark, where a rebound can be expected. Momentum indicators have also reached oversold territory which reflects the possibility of a recovery in the equity market. A breach of 2,900 can see the index hit 2,850 support level.

FACEBOOK COMMENTS