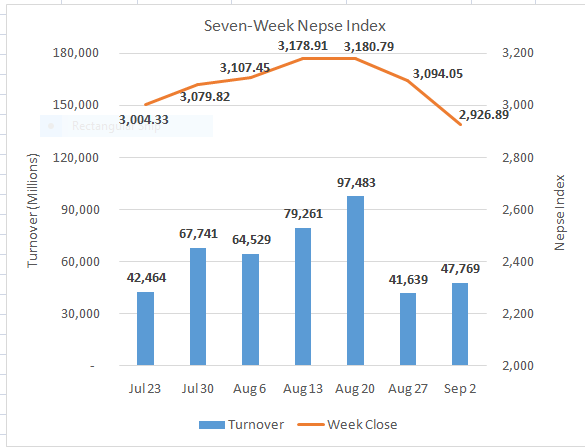

KATHMANDU, September 3: The stock market opened the week’s trading on a feeble note with the benchmark Nepse index tanking more than 49 points on Sunday. After a holiday on Monday, the index extended its downfall with another sharp decline of more than 69 points on Tuesday. Despite the market’s attempt to hold ground on Wednesday, Nepse saw another dip of more than 50 points on the last trading day of the week. Eventually, Nepse ended its 4-day trading week with a loss of 167.16 points or 5.40% at 2.926.89.

The equity market extended its weekly correction that came after NRB tightened the limit on loan against shares to individuals. Whilst there were no such restrictions earlier, the central bank’s directive curbed such loans for an individual to Rs. 12 crore. Consequently, the stock market took a hit with all of the sectors seeing selling pressure. However, with the index reaching close to its recent low of 2,800, the downward movement will likely subside in the coming week making way for another rebound. Average daily turnover stood at a moderate level with around Rs. 12 billion worth of equities exchanged per day.

Sensitive Index also tumbled reflecting weakness in Class ‘A’ stocks. The gauge dipped 5.18%. Hydropower sub-index fell the most among other composite sectors and closed the week 9.36% lower. Finance and Development Bank sub-indices followed suit with dips of over 8% apiece. Investment and ‘Others’ sectors declined around 7% each. All other segments dipped considerably, barring Hotels and Tourism sub-index which rose 1.48% higher.

Among actives, Arun Valley Hydropower Development Co. Ltd were traded the most with more than Rs. 3.5 billion worth of the energy stock changing hands. Arun Kabeli Power Ltd’s shares were also actively traded with almost Rs. 1.4 billion worth of the shares being traded in the week on review. Jeevan Bikas Laghubitta Bittiya Sanstha Ltd, Himalayan Distillery Ltd and Api Power Company Ltd followed suit with turnovers of more than Rs. 1.2 billion apiece.

As per the ARKS technical analysis, the index formed a strong bearish candlestick on the weekly timeframe signaling sellers control in the equity market. However, some loss of downward momentum can be expected with the Relative Strength Index (RSI) pulling back from the overbought territory after the correction. Further, 2900 can also be taken as a strong psychological mark which can provide support to the equity. Nonetheless, a volume backed recovery is crucial for buyers before taking any long position in the equity market.

FACEBOOK COMMENTS